Introduction Steve and Brad are both landlords in Carlsbad. Both own single-family homes in desirable neighborhoods. Both were eager to get their properties rented quickly. But what happened next shows just how different two outcomes can be when it comes to tenant screening.

Steve’s Costly Mistake Steve had a unit available and wanted to minimize vacancy. He met a prospective tenant who seemed polite, had cash in hand, and was ready to move in. Trusting his instincts, Steve skipped the background check, skipped the credit report, and didn’t verify the tenant’s income.

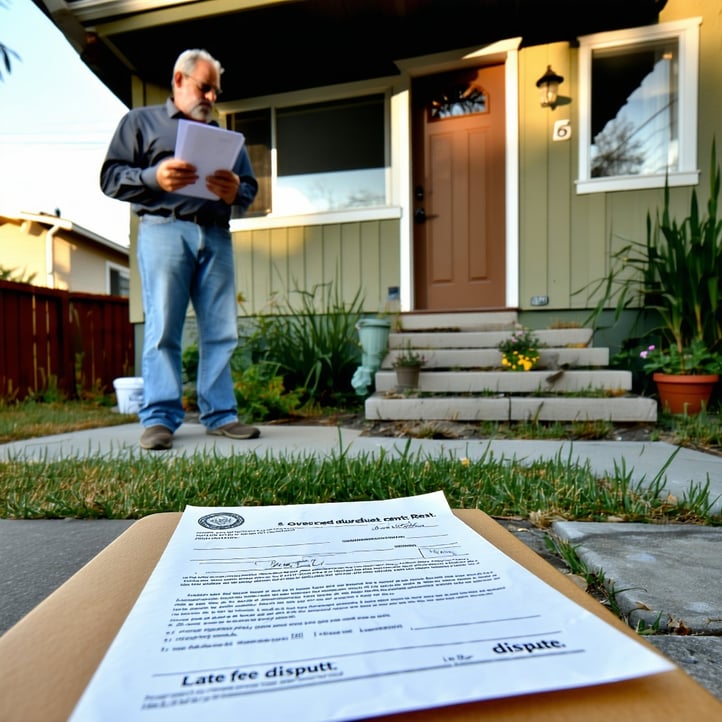

Two months later, rent stopped coming in. The tenant avoided calls, ignored notices, and eventually had to be evicted. That process took three more months, cost Steve over $5,000 in legal and lost rental income, and left him with a damaged property.

Brad’s Smart Approach Brad also had a vacancy but he took a different approach. He followed a standard screening process: background check, credit report, income verification, and consistent criteria for every applicant. Her chosen tenant passed every check.

The result? A long-term tenant who paid on time, respected the home, and even renewed their lease.

Why the Difference Matters Tenant screening isn't about being overly cautious—it's about protecting your investment. Using a checklist and applying the same criteria to every applicant ensures:

- Fewer missed rent payments

- Lower legal risk

- Longer tenancies

- Stronger relationships with tenants

What to Include in Your Screening Process

- Background check: Look for eviction history and criminal records

- Credit report: Identify financial red flags early

- Income verification: Ensure the tenant can truly afford the rent

- Consistency: Apply the same standards to every applicant to stay compliant with fair housing laws

- Reference checks: Contact prior landlords to verify reliability and behavior

Red Flags to Watch Out For

- Incomplete or inconsistent application info

- Eviction history or collections from previous landlords

- Poor or no credit history

- Refusal to provide income documentation

- Pressuring you to skip screening steps or move in immediately

Avoiding Legal Trouble Applying your criteria inconsistently or making decisions based on personal impressions can violate fair housing laws. Always document your screening standards and treat every applicant the same way. In California, landlords must also avoid asking certain prohibited questions about protected classes (source of income, family status, etc.).

FAQs

Q: Can I reject someone for a low credit score? A: Yes, as long as you apply the same standard to every applicant. Define your credit threshold in writing.

Q: What if someone doesn’t have rental history? A: That’s a judgment call but require stronger income documentation or a co-signer if needed. Again, be consistent.

Q: Is it legal to ask for bank statements or pay stubs? A: Yes. In fact, it’s best practice to verify ability to pay.

What Happened Next Steve now uses a property management company. He learned the hard way that tenant screening isn’t optional t’s foundational. Brad? He continues to grow her portfolio with peace of mind.

Conclusion Be like Brad. Protect your time, income, and investment with a proven screening process.

For more details, view our Rental Requirements page.

Need help finding great tenants? Request a free rental analysis today and let us show you how we can help.